Our Acquisition Approach

Our Acquisition Approach

Our Acquisition Approach

See how we execute on value-add opportunities

See how we execute on value-add opportunities

Our investment thesis targets underperforming commercial assets—specifically office, industrial, and mixed-use properties. We go beyond simple acquisition by fundamentally reimagining an asset's core purpose, transforming distressed or underutilized properties into vibrant, income-producing ecosystems. Through disciplined, hands-on operations and the strategic integration of our embedded service platforms, we create resilient cash flow.

Our investment thesis targets underperforming commercial assets—specifically office, industrial, and mixed-use properties. We go beyond simple acquisition by fundamentally reimagining an asset's core purpose, transforming distressed or underutilized properties into vibrant, income-producing ecosystems. Through disciplined, hands-on operations and the strategic integration of our embedded service platforms, we create resilient cash flow.

Approach

Approach

Braveheart Capital focuses on acquiring institutional-quality office, industrial, and mixed-use properties in the 100,000–700,000 square foot range. We target assets at strategic entry points and unlock value through repositioning, tenant activation, and embedded platform services. Our vertically integrated approach balances stable income with long-term appreciation, delivering resilient performance across market cycles.

Braveheart Capital focuses on acquiring institutional-quality office, industrial, and mixed-use properties in the 100,000–700,000 square foot range. We target assets at strategic entry points and unlock value through repositioning, tenant activation, and embedded platform services. Our vertically integrated approach balances stable income with long-term appreciation, delivering resilient performance across market cycles.

Four Timeless Principles

01

BASIS ARBITRAGE, NOT MARKET TIMING

BASIS ARBITRAGE, NOT MARKET TIMING

Acquire assets at 60–90% below replacement cost due to usage, financial, life-shift, market or other distress.

Acquire assets at 60–90% below replacement cost due to usage, financial, life-shift, market or other distress.

02

OPERATIONAL CONTROL WITH TACTICAL FLEXIBILITY

OPERATIONAL CONTROL WITH TACTICAL FLEXIBILITY

Operate with both in-house teams and third-party specialists for targeted repositioning.

Operate with both in-house teams and third-party specialists for targeted repositioning.

03

INCOME LAYERS FOR INVESTORS

INCOME LAYERS FOR INVESTORS

Capital Deployment Channels:

In-House Debt – Existing

New Equity Acquisitions

Short-Term 3rd Party Debt Fund Participation

Capital Deployment Channels:

In-House Debt – Existing

New Equity Acquisitions

Short-Term 3rd Party Debt Fund Participation

04

CREATIVE STABILIZATION PLATFORM

CREATIVE STABILIZATION PLATFORM

Embedding inter-dependent operating businesses.

Creating anchor tenants and ensure stable occupation.

Embedding inter-dependent operating businesses.

Creating anchor tenants and ensure stable occupation.

Vertical Integration

IndusPAD's vertically integrated platform eliminates execution risk by maintaining direct control over all critical functions from acquisition through asset stabilization. This comprehensive operational approach reduces costs, accelerates timelines, ensures quality standards, and maximizes returns while providing real-time market intelligence for strategic decision-making.

OUR EDGE

Opportunistic Timing

The current real estate landscape presents a complex dynamic, yet it is filled with opportunity. A significant dislocation has created a favorable market for strategic buyers, while an impending refinancing crisis opens the door for alternative capital providers. Explore below how these trends, combined with the recovery of the office sector, are shaping a unique moment for investment.

Looming Debt Maturities Create Immediate Refinancing Crisis

A significant wave of debt maturities is creating an immediate refinancing crisis for many property owners. This dislocation provides a window for alternative capital providers, like IndusPAD's debt fund, to offer essential capital when traditional lenders are retreating from the market.

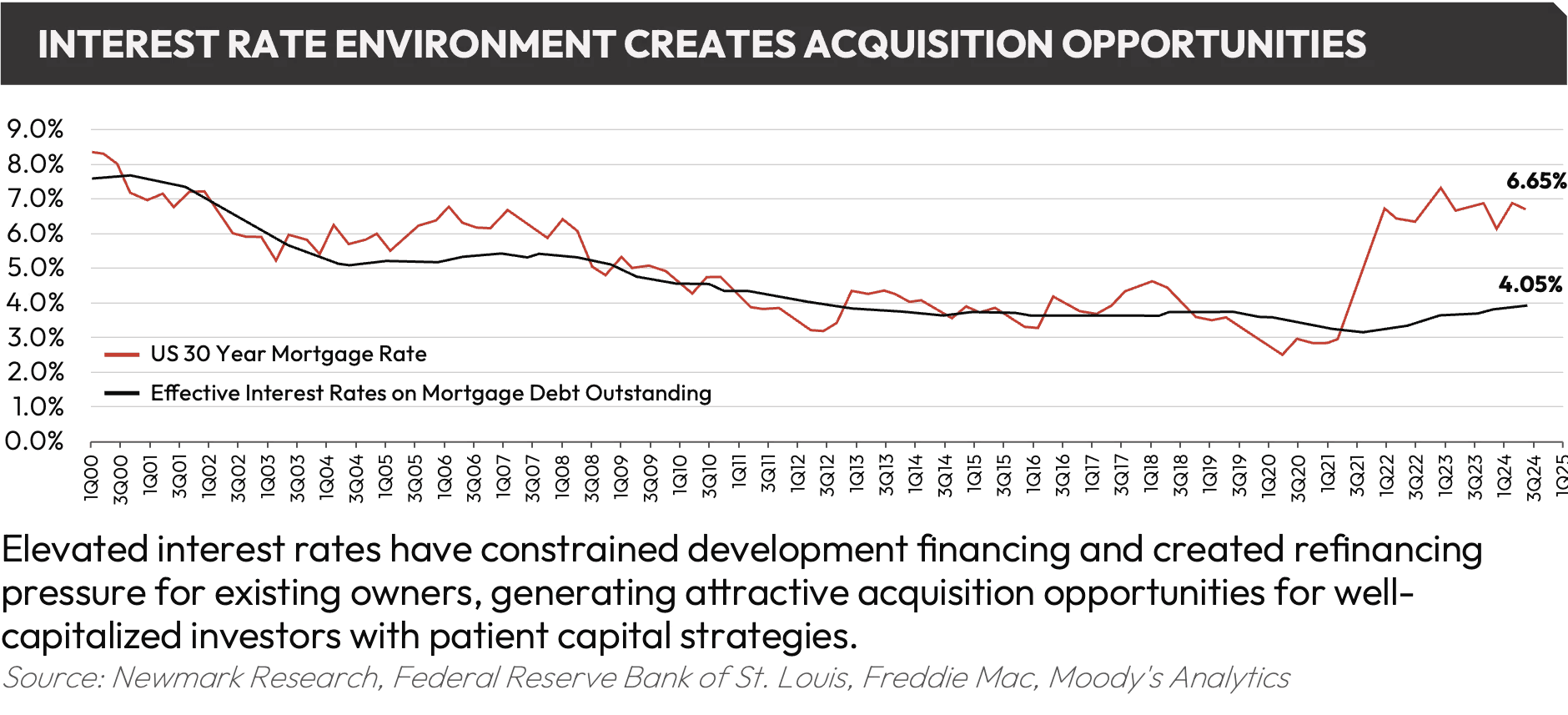

Interest Rate Reset Unlocks Office Acquisition Opportunities

Elevated mortgage rates have slowed new development and increased refinancing risk for highly leveraged owners. As pricing adjusts and distress emerges, patient capital is well positioned to acquire high quality assets at favorable basis as the rate environment normalizes.

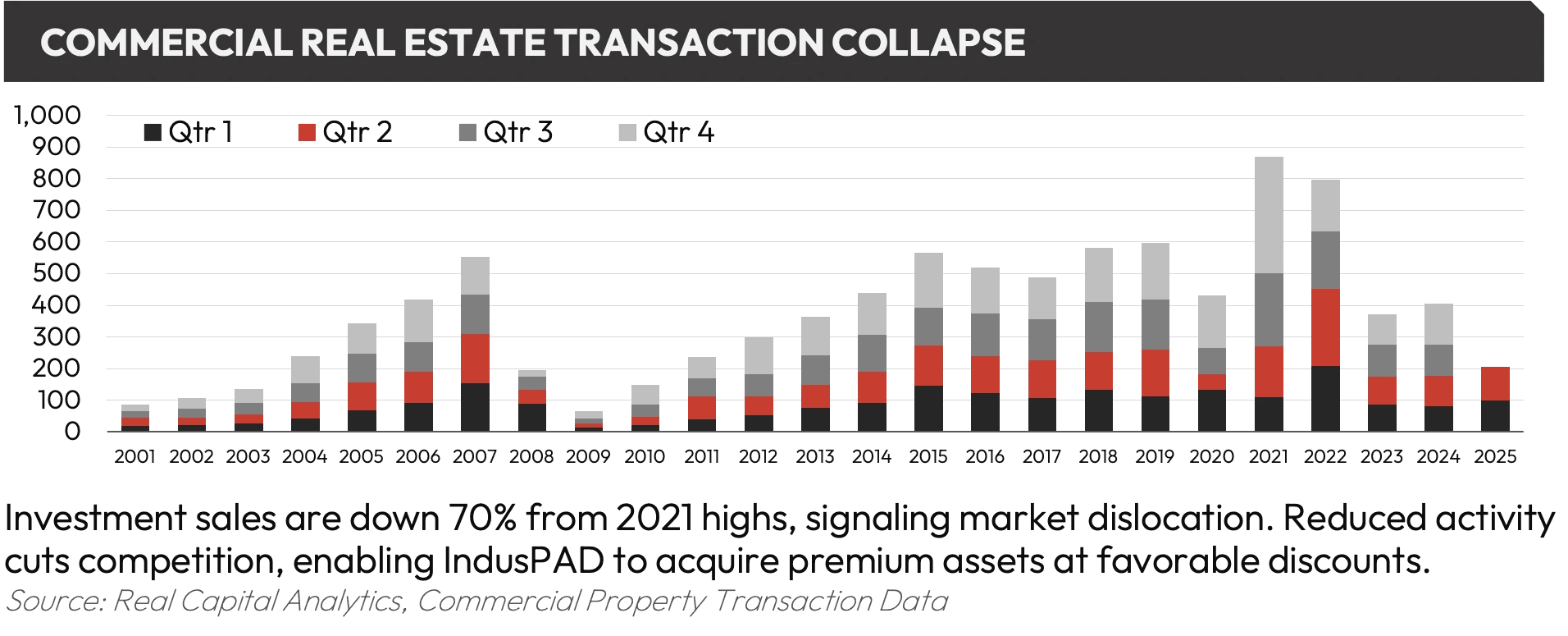

Transaction volumes have declined dramatically nationwide

With fewer active players in the market, strategic buyers now face significantly reduced competition. This grants them greater bargaining power, allowing them to negotiate favorable terms and conduct more thorough due diligence without the pressure of bidding wars.

CONTACT US

Get in Touch

Have questions about BraveHeart? or want to learn more about our investment approach? Connect with our team to explore opportunities or access additional information.

CONTACT US

Get in Touch

Have questions about BraveHeart? or want to learn more about our investment approach? Connect with our team to explore opportunities or access additional information.

CONTACT US

Get in Touch

Have questions about BraveHeart? or want to learn more about our investment approach? Connect with our team to explore opportunities or access additional information.